Articles

The fresh personality of a deposit as the an HSA, such as “John Smith’s HSA,” is enough to possess titling the brand new put as eligible for Single Membership otherwise Faith Membership publicity, dependent on if eligible beneficiaries is actually called. Such, a partner is the just owner of a full time income believe you to gets their wife an existence estate demand for the newest trust deposits, on the rest likely to their a few college students up on his partner’s dying. The fresh FDIC assumes that all co-owners’ offers are equal except if the new put membership info county if not.

Alliant Credit Connection

Having tariffs back into the headlines and many uncertainty as much as what the newest Given you are going to do next, it’s naturally a period of time to listen. The brand new Given’s holding regular for now, however, indeed there’s https://happy-gambler.com/crazy-luck-casino/ however speak from you’ll be able to incisions, and you may financial institutions is being competitive at the same time. If the locking inside an excellent Cd is something you’re considering, this is a sensible window. Yearly fee efficiency (APYs) and you may lowest deposits are among the issues that make up Bankrate’s rating. “To accommodate proceeded key town functions and security, sensible property, and areas, a number of the funds from the essential Area Features Financing are transmitted for the 2022 Working Budget.”

Why Salem Five Head?

- Examining profile are ideal for individuals who want to keep their money secure if you are nonetheless that have simple, day-to-date access to their money.

- If you have a vintage IRA Cd which you withdraw out of very early, you’ll need to shell out taxation for the that which you withdraw because the traditional IRAs is a back-income tax membership.

- I think about the newest financial institution’s support service alternatives, stability, shelter and you will cellular software analysis.

- To have banking institutions, make sure he has FDIC insurance, and for borrowing from the bank unions, make certain that they have NCUA insurance.

- “The metropolis features a diverse signal away from organization employment. We expect this may remain, even after particular suspicion nearby federal provides.”

But also for second year’s funds to equilibrium, Ginther indicates draining the brand new finance of almost another $fifty.9 million, taking the balance down to $10 million by the end out of 2022. Put differently, the metropolis usually drop to the their deals to fund police, fire, rubbish collection, parks, recreation and other first apps next year. If you are proclaiming his offer, Ginther highlighted this would not be a taxation improve. Ginther and you may Columbus Area Council President Shannon Hardin kept a press meeting Can get 22 so you can mention the newest city’s slope to help you voters at the the construction website from Flames Station thirty-six, and that obtained $17 million out of earlier area ties. Design of your own channel to the place away from Central University and you can Harlem Routes inside the northeast Columbus near The fresh Albany is decided so you can become complete in the March 2026.

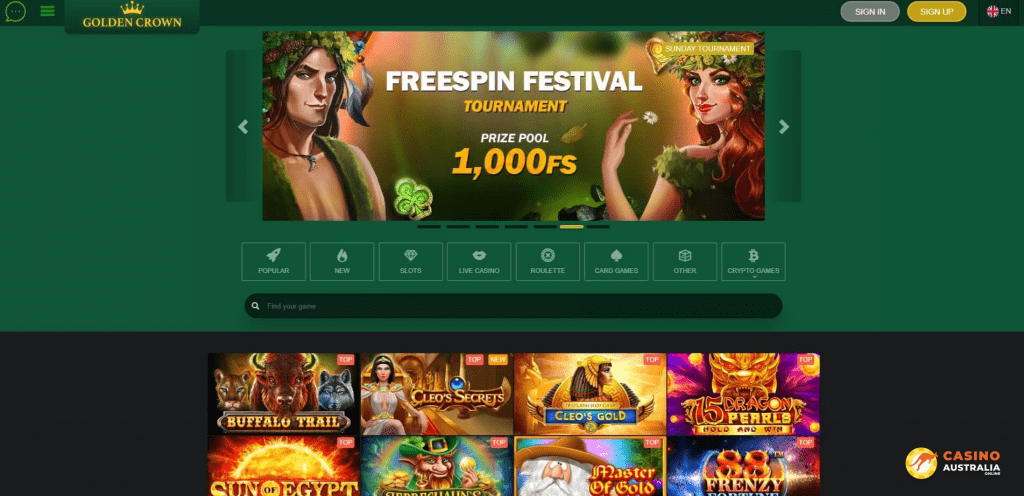

A person need not be a great U.S. resident or citizen for his or her deposits insured by the brand new FDIC. The Covered Deposits are a thorough malfunction away from FDIC put insurance rates exposure for preferred account ownership categories. Please merely play having financing to easily be able to get rid of. Once we perform all of our greatest to offer helpful advice and you can guidance we cannot getting held responsible the loss which can be obtain right down to gambling.

That it grace period gets a good depositor the opportunity to reconstitute his otherwise the girl accounts, if required. Whether or not home loan servicers usually collect income tax and you may insurance (T&I), these accounts is independently handled rather than thought home loan upkeep account to possess put insurance rates aim. T&I deposits belong to the fresh borrower’s pending percentage of the a property fees and you can/or assets advanced to your taxing authority otherwise insurance carrier. The brand new T&We places is actually covered to the an excellent “pass-through” basis to the consumers.

When you yourself have a non-IRA Video game, you’ll need to pay taxation for the attention your own Dvds make yearly. As long as you are not withdrawing money from the early, you will not need to pay fees yearly on your IRA Dvds. It works identical to conventional Dvds, but they features some other legislation in terms of the fresh taxation you have to pay and exactly how your withdraw currency. An educated 5-season Dvds can give lower prices compared to the other terminology to the our very own number, however they are still preferred options for investors.

Actually, this year’s finances boasts an extra $633.one million inside the “carryover investment” that was appropriated to own investing inside the past money budgets, using full to help you $step 1.74 billion. On the affordable homes portion, Enough time listed affordable houses bonds have previously supported the building out of over 4,100000 local rental products in the Columbus, along with more 630 products from long lasting supportive homes. The brand new mayor’s work environment says the new finances suggestion will mitigate “economic drop out” regarding the pandemic and you may restore key supplies and you may wants for the city’s rain date fund while you are benefiting owners and you may neighborhoods. The newest 2023 General Fund finances totals $step one.14 billion to own programs, features and you can concerns of your own town, according to the mayor’s office.

A certification away from deposit try a bank checking account that needs your in order to secure finance away to possess a predetermined age days or many years in exchange for a fixed interest rate which is often more than most other bank accounts. We have chose the major Video game products from banking companies and you may borrowing from the bank unions using all of our savings account strategy. We rate financial issues on the a level from a single to four celebrities, that have one superstar being the lowest rating and you will five-star getting the best rating it is possible to. Financial institutions and you can borrowing from the bank unions also need to stand just like per most other to achieve success, so creditors along with ft its rates about what almost every other economic organizations have to give. Quorum have good cost for the 18-few days Cd, which it phone calls an expression Savings account.

Ginther tries almost $dos billion inside ties to have affordable property, Columbus parks, shelter

Otherwise, fool around with Irs’ Mode 8888, Allocation away from Reimburse, for those who file a paper go back. If you’d like the brand new Irs so you can put their reimburse on the merely you to definitely membership, utilize the direct deposit range on the tax function. If you have a great prepaid debit card, you are able to have your reimburse deposited to the cards. Of several reloadable prepaid service notes provides membership and you may navigation amounts which you provide to your Irs. Talk with the lending company to be sure your card might be utilized also to have the navigation count and you will account matter, which are distinctive from the newest credit count.

The proper time for Cds eventually depends on their deals needs, but when you’re also in the market for him or her, think securing inside the highest Computer game rates as they past. More than fifty analysis issues experienced for each and every bank and borrowing partnership becoming qualified to receive all of our listing. Because of it Cd listing, more four research issues was sensed for each organization.

Including establishing continual transfers from your checking to help you the checking account. Bear in mind there is certainly a new render to own consumers in the New jersey and you can Pennsylvania, even though both of them is actually earliest-put matches incentives. When you allege the newest Twist Palace Gambling enterprise promo password, keep in mind that you must meet the wagering criteria so you can withdraw your own incentive money, which is 30x the put as well as incentive fund. Effect on their borrowing from the bank can vary, as the credit scores is on their own influenced by credit bureaus considering lots of items such as the monetary conclusion you create which have other economic services groups.