Blogs

The newest banks’ twigs within the rural section is also boost the business instances (we.e. amount of days, and timings) and the each week vacations to match local standards. Banks are not allowed to costs foreclosure charge / pre-commission punishment on the all floating price term fund sanctioned to personal individuals. (iv) Banks get set up device to possess acceleration check into the newest level of purchases effected a day / per beneficiary and you may one skeptical functions is going to be confronted with alert inside the lender and also to the consumer. When you are obtaining the consult letter regarding the depositor to possess revival, banking companies also needs to indicates him to indicate the phrase whereby the new deposit will be revived. If the depositor doesn’t get it done his option of choosing the word to own revival, banks will get renew the same to own a term equal to the new brand-new name.

Nội dung

Post office Discounts Strategies

Working part-date opened their vision to help you a scene outside of the you to definitely she got previously identified, where you to never had to bother with currency. She’ll getting an open guide to the out of his concerns, however, Joon-ki claims they could bring the time. Declaring which they’ve just wanted to come across each other today, the guy asks the woman over to food, dealing with himself as the a guy who “wins” date or nights (i.elizabeth., constantly gets his way). One to complements Ji-yi’s habit of always throw in the towel, and it also’s merely just after the guy directs her on her behalf way do Chang-soo enter a smile.

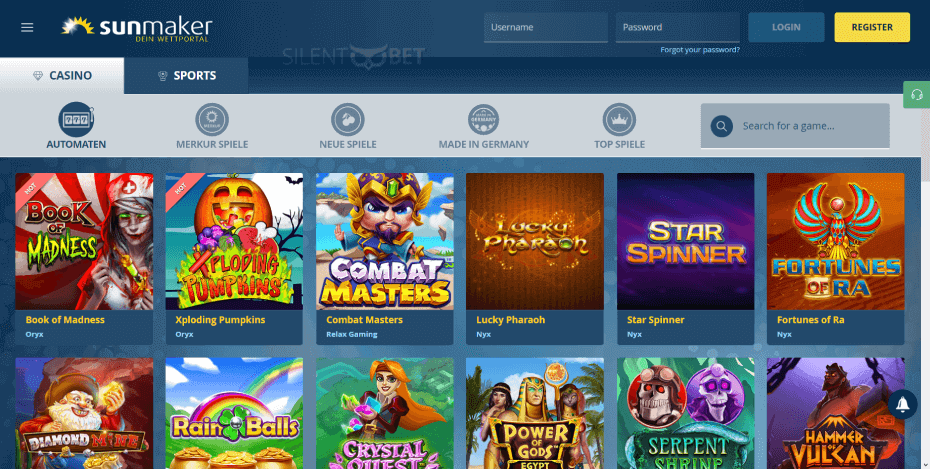

Usually Free to Play

Whenever Yoon-ha says she loved Ji-yi’s frankness and you may transparency, he asks how a couple might be close friends when one to features secrets in the most other. It’s great just how unamused Chang-soo is via it story, however, their point is the fact times has changed and they’re also from equal status today. Chang-soo contends there’s nevertheless an improvement, however, she retorts you to doesn’t suggest one ranks greater than the other.

Already Airing

- When you are not all the Canadian providers has a good 5 min deposit local casino option, the recommended sites over have the ability to started confirmed as the this.

- An extra unicamente black-jack playing approach, he wound-upwards toppling the fresh April 2011 fund out of Tropicana Casino, that have already acquired 9 million from the two nearly any casinos.

- For each player will love great bonuses, specifically, gamblers quickly found 5percent of the put corresponding to the value of the total amount whenever deposit money to the account.

- Inside the Wales, home buyers pay Home Deal Income tax (LTT) instead of SDLT.

The major higher-yield savings account (HYSA) rates remain carrying solid — a pleasant change from the newest stone-bottom efficiency one to traditional stone-and-mortar banking https://happy-gambler.com/western-belles/ institutions give. After the Fed selected never to to alter rates of interest from the the Summer 18 conference, HYSAs still offer productivity a lot more than cuatro.00percent APY. Regular offers membership can offer high interest rates than many other deals account, many need you to have a recently available account for the same supplier. Matter prices of cash licenses should be circular of inside a similar manner. Although not, financial institutions is to make certain that cheques/drafts provided by subscribers which has fractions from an excellent rupee aren’t rejected or dishonoured by the her or him.

Perform they give the same rates of interest?

When they artificially pushed too much, they create financial troubles. If they are forcibly pushed too lower, they create financial difficulties. Manage your profile, look at the harmony, post currency, and you will secure benefits.

Have you discovered an appropriate the newest generate, however, incapable of know very well what type of financial you’ll you would like? In this article i’ll description the huge benefits, the choices available, and how we are able to assist. If the one thing doesn’t end up being correct, believe your own instincts and take enough time to analyze.

Make sure to examine a few options on the form of banking institutions you happen to be most comfortable having. The common APY, or annual commission give, on that Cd now stands from the step 1.83percent, unchanged of yesterday. While the chart lower than reveals, efficiency can be increase easily in the event the Given hikes cost, nevertheless they can simply as easily slide in the event the cuts happen afterwards this year.

Yet not, there’s no universally arranged-up on definition by what qualifies since the a “jumbo” Video game. Particular banking institutions and you may credit unions smack the newest name “jumbo” to the Dvds you could discover with fifty,100000, twenty five,one hundred thousand if you don’t quicker. First-day buyers must budget precisely when taking out an excellent 95percent LTV bargain. Do your homework so that you’re confident you know what their complete month-to-month expenses and you may costs are likely to be. This might involve checking council income tax groups or benefiting from forecasts to possess power bills for the new home. We really do not generate, nor will we attempt to create, any suggestions otherwise customised advice on financial products or functions one to is actually managed by FCA, even as we’re also maybe not regulated or authorised because of the FCA to give you advice like this.

For example, should your rates away from rising cost of living try 4percent your savings come in a free account investing dospercent, your bank account loses several of their to find strength as it won’t be able to get as much as they performed before. If the offers earn lower than the interest rate from which the new can cost you of products and functions try rising, your money loses to purchase electricity (i.age. an identical matter purchases reduced). Precisely the attention earned on your own deals is likely for tax and you will, even then, you’ll just need to spend income tax for those who discovered above a great certain quantity of great interest within a single tax-seasons (labeled as your Offers Allotment). Discounts profile allows you to independent currency which you’re putting aside money for hard times from your own go out-to-time extra cash that you’ll require to have expenses and you may shopping, such as. So you can choose which bucks instruments—otherwise combination of instruments—are right for you, we have outlined all of today’s rates less than, newest by Jan. ten, 2025. U.S. Treasury I bonds are a kind of bond having a speeds you to changes twice a year in order to fall into line having rising prices style.

That it associate analogy assumes on mortgage repayments are made to the first day’s a calendar month. How higher discounts rates of interest goes is probably the wrong question; you’lso are better off asking, “How reduced might they slip? ” That’s since the Government Reserve is done elevating interest levels.